Personalized Portfolio Optimization for Individual Investors

Tailoring Investment Strategies to Individual Needs

Personalized portfolio optimization is crucial for individual investors, moving beyond generic strategies that may not align with unique financial goals, risk tolerances, and time horizons. AI-powered platforms can analyze individual investor profiles, including income, expenses, existing assets, and desired retirement goals, to craft portfolios that are meticulously tailored to meet those specific needs. This approach recognizes that a one-size-fits-all investment strategy is rarely effective and often leads to suboptimal outcomes. By factoring in individual circumstances, AI algorithms can dynamically adjust portfolio allocations to maintain a balance between risk and reward, thus enhancing the likelihood of achieving long-term financial success for each individual investor.

Moreover, these personalized strategies adapt to changing circumstances. Life events, such as job changes, family additions, or unexpected financial burdens, can significantly impact investment needs. AI-driven portfolio optimization systems can proactively adjust strategies as these factors emerge, ensuring that the portfolio remains aligned with the investor's evolving financial objectives. This adaptability is a significant advantage over static investment plans, allowing for greater resilience and flexibility in navigating life's inevitable twists and turns.

Leveraging AI for Enhanced Portfolio Performance

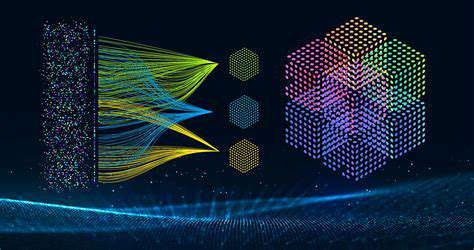

AI algorithms excel at analyzing vast amounts of market data, including historical trends, news sentiment, and economic indicators, to identify potential investment opportunities and assess market risks. This capability goes beyond human analysis, enabling the identification of subtle patterns and correlations that might otherwise be missed. By processing this data, AI can predict market fluctuations with a degree of accuracy that is often superior to traditional methods. This allows investors to make more informed decisions, potentially leading to higher returns and reduced losses.

Beyond predictive capabilities, AI can also automate rebalancing, a critical aspect of portfolio management. Rebalancing involves adjusting asset allocations to maintain the desired risk-reward profile. Manual rebalancing can be time-consuming and prone to human error. AI can execute these adjustments automatically and promptly, ensuring that portfolios remain aligned with the defined strategy. This automation not only saves time for investors but also reduces the likelihood of emotional decision-making, a frequent culprit in poor investment choices.

AI-powered portfolio optimization tools can also offer valuable insights into risk management. By evaluating the correlation between different asset classes, AI can identify potential vulnerabilities and suggest diversification strategies to mitigate risk. This proactive risk assessment allows investors to safeguard their capital while pursuing their financial goals, making AI a valuable tool for both seasoned and novice investors.

Challenges and Considerations in AI-Driven Portfolio Optimization

Data Availability and Quality

A critical aspect of AI-driven portfolio optimization is the availability and quality of the data used to train and evaluate the models. AI algorithms require vast quantities of historical market data, including stock prices, economic indicators, news sentiment, and social media trends. However, accessing and ensuring the accuracy and completeness of this data can be challenging. Data discrepancies, biases, and incomplete information can lead to inaccurate model predictions and ultimately, suboptimal investment strategies. Furthermore, the sheer volume of data necessitates robust data management and preprocessing techniques to avoid issues like data leakage and overfitting.

Maintaining the quality of data over time is equally important. Market conditions, economic events, and regulatory changes can all impact the relevance of historical data. AI models need to be regularly updated and retrained to adapt to these evolving market dynamics and ensure continued accuracy. Failure to address these issues can lead to a significant performance gap between the model's predictions and actual market outcomes.

Model Complexity and Interpretability

Many AI models used in portfolio optimization, such as deep learning networks, are highly complex and opaque. While these models can potentially capture intricate market relationships and generate impressive performance, their lack of interpretability makes it difficult to understand why a particular investment decision was made. This lack of transparency can create challenges for risk management, as investors may not fully grasp the factors influencing the model's recommendations. Moreover, understanding the reasoning behind a model's output is crucial for building trust and confidence in its predictions.

Striking a balance between model performance and interpretability is key. Techniques like explainable AI (XAI) can help to shed light on the decision-making process of these complex models, increasing confidence and enabling better oversight of the investment strategy.

Computational Resources and Cost

Implementing and maintaining AI-driven portfolio optimization systems requires significant computational resources. Training sophisticated machine learning models, especially deep learning architectures, often demands substantial processing power and memory, potentially leading to high computational costs. The need for specialized hardware, such as GPUs, can further increase the infrastructure requirements and associated expenses. Scalability of the system to handle increasing data volumes and model complexity is another important consideration.

The cost of maintaining and updating these systems, including software licenses, cloud computing costs, and potentially hiring specialized personnel, needs careful consideration to avoid unforeseen financial burdens. Optimizing the model's architecture and implementation to minimize computational demands is crucial to make AI-driven portfolio optimization more accessible and cost-effective.

Algorithmic Bias and Fairness

AI models are trained on data, and if that data reflects existing societal biases, the models will likely perpetuate and even amplify those biases in investment decisions. This can lead to unfair or discriminatory outcomes, potentially impacting different demographic groups disproportionately. For example, if historical data predominantly reflects the investment preferences of certain demographics, the model might favor similar strategies in the future, potentially overlooking other opportunities or investment options that could be beneficial to a broader range of investors.

Developing and deploying AI models that are fair and equitable requires careful consideration of data representation and the use of techniques to mitigate bias. Regular audits and ongoing monitoring of model performance are essential to ensure that the investment strategies remain unbiased and inclusive.

Regulatory and Ethical Considerations

The use of AI in investment management raises important regulatory and ethical questions. There are ongoing debates about the responsibilities of investment firms using AI algorithms and the potential for conflicts of interest. Clear guidelines and regulations are needed to ensure that AI-driven investment strategies are aligned with established ethical principles and financial regulations. Transparency and accountability are crucial in building trust and ensuring that AI tools are used responsibly in the financial sector.

Compliance with existing regulations and the development of new regulatory frameworks tailored to AI in finance are crucial for navigating the legal and ethical landscape and preventing potential misuse or unintended consequences. Ethical considerations regarding data privacy, algorithmic transparency, and potential bias in AI models must be proactively addressed to maintain public trust and uphold the integrity of the financial system.