Enhanced Client Communication and Engagement

Improved Client Onboarding and Support

Implementing AI-powered chatbots and virtual assistants can significantly streamline the client onboarding process. These tools can handle initial inquiries, gather necessary information, and guide clients through the setup process, freeing up financial advisors to focus on more complex and personalized interactions. This not only improves efficiency but also significantly reduces the time clients spend waiting for responses, creating a more positive initial experience and fostering a sense of trust and value. The use of AI can significantly reduce the time needed for preliminary client information gathering and ensure faster turnaround times for client support requests, which is crucial for client satisfaction in the increasingly fast-paced world of finance.

Furthermore, AI-driven systems can provide 24/7 support, ensuring clients have access to assistance whenever needed. This accessibility is invaluable, particularly for clients in different time zones or those who prefer to communicate outside of traditional business hours. The 24/7 availability of AI assistants also allows financial advisors to dedicate more time to building deeper relationships with their clients and providing personalized advice, which is essential for long-term client engagement and retention. Client satisfaction is demonstrably higher when clients feel supported and understood.

Personalized Financial Advice and Recommendations

AI algorithms can analyze vast amounts of data about individual clients, including their financial goals, risk tolerance, investment history, and market trends, to generate highly personalized financial advice and recommendations. This data-driven approach allows for tailored investment strategies that are optimized for each client's unique circumstances and objectives. By leveraging AI, advisors can provide clients with more sophisticated and data-backed recommendations, which leads to more informed decision-making and ultimately, better financial outcomes. This level of personalized service builds trust and strengthens the advisor-client relationship.

AI can also identify potential risks and opportunities in a client's portfolio, proactively alerting advisors to potential issues and suggesting adjustments to mitigate them. This proactive approach empowers advisors to make informed decisions and provide timely interventions, ultimately safeguarding client assets and maximizing returns. The ability of AI to analyze vast amounts of data and predict market trends allows advisors to anticipate potential challenges and opportunities, enabling them to make more accurate and proactive financial strategies.

Enhanced Client Engagement and Relationship Building

AI can facilitate deeper client engagement by providing clients with personalized insights, interactive tools, and educational resources. These resources can cover topics such as investment strategies, market trends, and financial planning, allowing clients to stay informed and involved in their financial journey. This proactive engagement fosters a stronger relationship between the advisor and the client, allowing for more open communication and a greater understanding of individual needs. It also allows clients to feel empowered and informed, which is crucial for building long-term trust and confidence in the advisory relationship.

By providing customized content and interactive tools, AI can cater to diverse learning styles and preferences. This creates a more dynamic and engaging client experience, fostering a sense of active participation and ownership over financial decisions. This personalized approach helps to build stronger relationships with clients, creating a sense of trust and collaboration in the financial advisory process. The ability to provide tailored content leads to more satisfied clients and ultimately improves the overall client experience.

The Future of Financial Advisory: Integrating AI into the Ecosystem

AI-Powered Personalized Financial Plans

Artificial intelligence (AI) is poised to revolutionize financial advisory by enabling the creation of highly personalized financial plans. By analyzing vast datasets of individual financial situations, AI algorithms can identify unique needs and goals, crafting tailored investment strategies, retirement projections, and even estate planning recommendations. This personalized approach goes beyond generic advice, offering solutions deeply rooted in individual circumstances, risk tolerance, and aspirations, ultimately leading to more effective and satisfying outcomes for clients.

Imagine a system that proactively adjusts investment portfolios based on market fluctuations and individual risk profiles. This level of dynamic adaptation is currently unimaginable without AI. The potential for improved financial outcomes is significant, moving beyond basic financial planning to a proactive, personalized, and adaptable approach.

Enhanced Portfolio Management with Algorithmic Trading

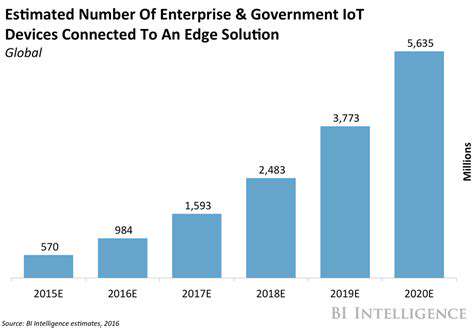

AI-driven algorithmic trading can significantly enhance portfolio management by automating investment decisions based on real-time market data. These algorithms can scan the market, identify opportunities, and execute trades with speed and precision that far surpasses human capabilities. This automation reduces emotional decision-making and minimizes the impact of market volatility on portfolio performance, leading to potentially higher returns and reduced risk.

Furthermore, AI can optimize portfolio diversification by identifying and analyzing correlations between various asset classes. This sophisticated approach to portfolio construction minimizes exposure to correlated risks, maximizing potential returns while maintaining a safe and diversified investment strategy. The ability to adapt to changing market conditions is critical, and AI algorithms can react dynamically to these shifts.

Predictive Analytics for Investment Forecasting

AI algorithms excel at analyzing vast amounts of data to predict future market trends and investment performance. By identifying patterns and correlations in historical market data, economic indicators, and news sentiment, AI can provide valuable insights into potential investment opportunities and risks. This predictive capability empowers financial advisors to make more informed decisions and offer clients proactive strategies for maximizing returns and mitigating potential losses.

Integrating predictive analytics into financial advisory can enable proactive risk management. Advisors can anticipate potential market downturns and adjust investment portfolios accordingly, potentially minimizing the impact of economic shocks on client wealth. This level of foresight is invaluable in navigating the complex and dynamic financial landscape.

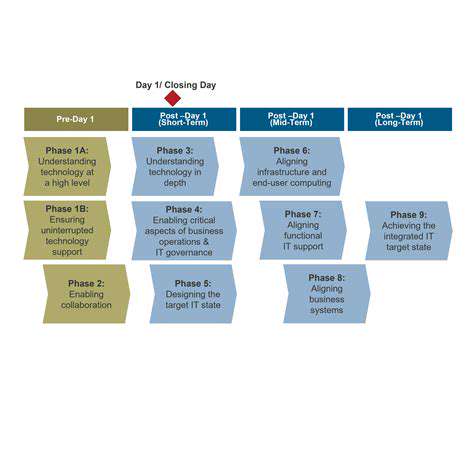

Improved Client Onboarding and Communication

AI can streamline the client onboarding process, reducing administrative burdens and improving the overall client experience. AI-powered chatbots can answer frequently asked questions, schedule appointments, and gather necessary information, freeing up advisors to focus on building strong client relationships and providing personalized financial guidance. This increased efficiency ultimately leads to a more accessible and streamlined service for clients.

AI-Driven Risk Assessment and Mitigation

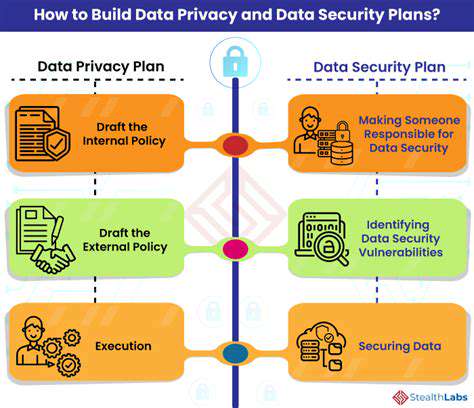

Accurate risk assessment is crucial in financial advisory. AI can analyze a client's financial situation, risk tolerance, and investment objectives to provide a comprehensive risk profile. This allows advisors to tailor investment strategies to align with individual risk profiles, minimizing potential financial losses. The ability to accurately assess and mitigate risks is a significant advancement, leading to more secure and sustainable financial plans.

Moreover, AI can help identify and assess potential financial risks in real-time, enabling proactive mitigation strategies. This proactive approach to risk management is critical for safeguarding client assets and ensuring long-term financial security. This goes beyond simply identifying potential issues; it empowers advisors to take decisive action to protect their clients' portfolios.

Enhanced Fraud Detection and Security

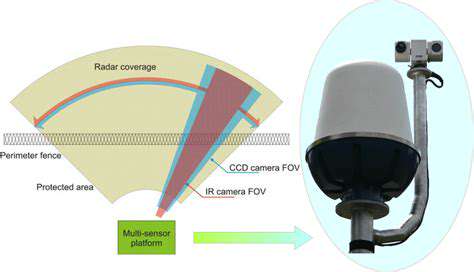

AI plays a vital role in enhancing the security of financial advisory services by identifying and preventing fraudulent activities. AI algorithms can analyze transactions, identify suspicious patterns, and flag potential security breaches in real time. This proactive approach to fraud detection safeguards client data and assets, fostering trust and confidence in the financial advisory process. This is crucial in today's environment where cyber threats are constantly evolving.

Implementing robust security measures is paramount. AI-powered security systems can detect and respond to threats with unprecedented speed and efficiency, minimizing the risk of financial losses due to fraud or breaches. This enhanced security translates to a more secure and reliable financial advisory experience for clients.