The Evolving Landscape of Payment Fraud

The Rise of Digital Wallets

Digital wallets have transformed how payments are made, combining ease of use with robust security features. By removing the necessity for physical currency or plastic cards in numerous scenarios, they've redefined transactional efficiency. This change mirrors the wider adoption of mobile-centric solutions that embed payment capabilities into commonly used applications and gadgets.

Mobile Payment Platforms

Smartphone-based payment systems are fundamentally changing commerce dynamics. These platforms deliver intuitive interfaces for completing purchases across various mobile devices. Their introduction has notably increased financial inclusion, especially in developing economies where traditional banking infrastructure may be lacking.

The Impact on Physical Retailers

Traditional stores face mounting pressure to modernize their payment acceptance methods. Many now integrate mobile payment alternatives with conventional options to stay relevant in an increasingly digital marketplace. This strategic adaptation proves essential for preserving customer relationships and boosting revenue in our technology-driven era.

Security Challenges and Solutions

With payment systems becoming deeply embedded in daily activities, security remains a top priority. Implementing strong protective measures is non-negotiable for shielding sensitive financial data. Advanced encryption standards and layered authentication protocols form the backbone of secure transactions. Maintaining these safeguards is paramount for preserving consumer trust in digital payment ecosystems.

Tomorrow's Payment Landscape

The trajectory of payment technology points toward deeper integration and continuous innovation. We're moving toward a reality where effortless contactless payments dominate, supported by cutting-edge security. Biometric verification and intelligent algorithms will play pivotal roles in creating more secure and personalized payment experiences. The coming years will likely witness further refinement of seamless, customized transaction methods.

Innovative Payment Alternatives

Alongside conventional options, novel payment approaches are gaining momentum. Digital currencies, for instance, are emerging as viable exchange mediums, despite ongoing regulatory developments. These advancements are disrupting traditional financial models, potentially fostering more distributed and accessible economic systems. Technologies like distributed ledgers are positioned to dramatically influence future payment infrastructures.

Global Payment Protocols

Standardized international payment frameworks are vital for enabling smooth cross-border commerce. Establishing uniform standards promotes interoperability and efficiency in worldwide transactions. Creating reliable, secure global payment specifications is fundamental to international business operations. Such standards also improve the consistency and velocity of financial exchanges across nations.

AI's Role in Payment Fraud Prevention

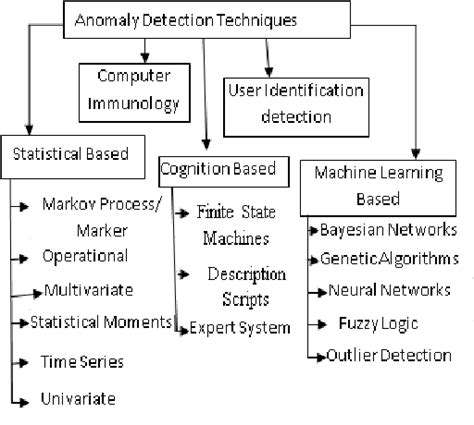

AI-Powered Anomaly Detection

Artificial intelligence demonstrates exceptional pattern recognition capabilities that prove invaluable for fraud identification. By examining extensive transaction datasets encompassing elements like geographic location, timing, monetary value, and payment method, AI systems can detect abnormal patterns signaling potential fraud. This functionality enables swift recognition of transactions deviating from established behavioral norms, dramatically enhancing fraud prevention effectiveness. This forward-looking strategy proves critical in today's digital environment where fraudulent techniques constantly evolve.

Machine learning models, a specialized AI application, can assimilate historical data and adjust to emerging patterns. This adaptive learning capacity allows systems to anticipate new fraudulent schemes. The technology's ability to apply learned knowledge to fresh transactions represents a game-changing advantage in fraud combat. Continuous learning ensures sustained accuracy in spotting fraudulent activities despite perpetrators' evolving tactics.

Comprehensive Transaction Analysis

AI transforms transaction monitoring by evaluating multiple variables concurrently, surpassing human analytical capacity. This comprehensive approach facilitates detailed examination of each transaction, uncovering subtle fraud indicators that might otherwise escape notice. Processing enormous data volumes rapidly enables AI to inspect transactions for irregularities, leading to quicker fraud detection and prevention. Such operational efficiency is vital for reducing financial losses and safeguarding customers.

Beyond anomaly detection, AI can interpret transactions within each user's behavioral context. This nuanced understanding is crucial since activities considered unusual for one individual might represent normal behavior for another. AI-powered systems make these critical distinctions, minimizing false alerts and improving overall user satisfaction.

Predictive Analytics for Fraud Prevention

AI's forecasting abilities prove particularly valuable for proactive fraud mitigation. By studying historical patterns, AI models can assess fraud probability before transactions occur. This preventive methodology outperforms reactive approaches, enabling financial institutions to implement protective measures like blocking questionable accounts or transactions preemptively. This predictive power provides substantial advantages in fraud prevention efforts.

Predictive modeling also facilitates sophisticated risk evaluation frameworks. These frameworks can calculate risk levels for specific transactions and users, allowing targeted interventions to stop fraud before it happens. Identifying high-risk transactions helps financial organizations focus resources strategically, reducing fraud impact while protecting payment system integrity.

Instantaneous Fraud Prevention

AI's real-time processing capacity is indispensable for effective fraud deterrence. By analyzing transaction data immediately, AI systems can make split-second approval or denial decisions. This instantaneous decision-making proves essential for countering modern digital fraud characterized by speed and precision. Rapid response capabilities help financial institutions address suspicious activity promptly, minimizing potential losses and ensuring secure customer transactions.

The combination of speed and accuracy in AI-powered fraud detection is crucial for customer protection and payment system reliability. Real-time data analysis empowers financial institutions to make informed decisions swiftly, significantly enhancing transaction security and preventing substantial monetary losses.

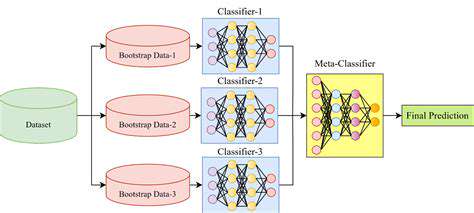

Machine Learning Techniques for Anomaly Detection

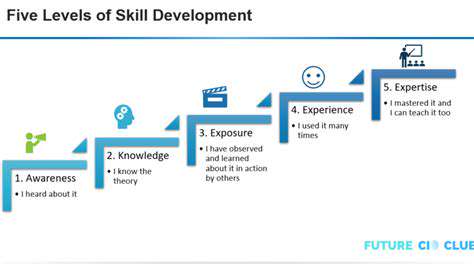

Supervised Learning

Supervised learning methods utilize labeled training data, where each entry includes corresponding outcome information. This enables algorithms to discern relationships between input variables and target outcomes before applying this knowledge to new data. Common implementations encompass linear regression, logistic regression, and support vector machines (SVMs). These approaches prove especially effective when predicting specific outcomes or classifying information into predefined groups.

Feature selection represents a critical consideration in supervised learning. Appropriately chosen features can substantially enhance model accuracy and performance. Ideal features show strong correlation with target variables while minimizing redundancy. Improper feature selection or interpretation frequently leads to prediction errors and suboptimal model performance.

Unsupervised Learning

Unlike supervised approaches, unsupervised learning works with unlabeled data to uncover hidden structures or relationships. Popular techniques include clustering algorithms such as k-means and hierarchical clustering, along with dimensionality reduction methods like principal component analysis (PCA).

Unsupervised learning proves particularly useful for exploratory analysis, anomaly identification, and customer segmentation. These methods reveal underlying data patterns that can inform subsequent analysis or strategy development. For example, distinguishing customer groups based on buying habits can enable more focused marketing initiatives.

Reinforcement Learning

Reinforcement learning trains decision-making agents through environmental interaction and feedback mechanisms. The agent refines its approach based on rewards or penalties received for various actions. This iterative process enables the development of optimized behaviors over time. Applications range from robotic navigation systems to artificial intelligence for gaming.

Designing appropriate reward functions represents a critical component of reinforcement learning, as these guide the agent's learning trajectory. The reward structure must precisely reflect desired outcomes to ensure the agent develops intended capabilities.

Deep Learning

Deep learning employs multi-layered neural networks capable of discerning complex data patterns and representations. These networks excel at high-level cognitive tasks including visual recognition, language processing, and speech interpretation. Deep learning models typically demand significant computational resources and extensive training datasets.

The capacity of deep learning systems to autonomously develop hierarchical data representations offers substantial advantages. This capability enables extraction of sophisticated insights from complicated datasets, surpassing traditional method limitations. This proves particularly beneficial in specialized fields like medical diagnostics and financial market analysis.

Performance Assessment and Model Choice

Evaluating and selecting optimal machine learning models is fundamental to achieving project objectives. Various metrics including accuracy, precision, recall, and F1-score help assess model performance across different datasets. Understanding metric nuances proves essential for making informed model selection decisions.

Dataset characteristics and project goals should guide model selection. Performance can vary significantly across different data contexts. Successful model implementation requires balancing complexity with available data and performance requirements.