Unlocking Hidden Patterns

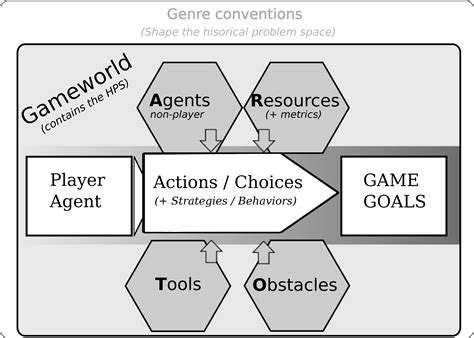

Modern equity research leverages advanced computational techniques to analyze vast datasets of financial information. These methods reveal complex interconnections that might escape traditional analytical approaches. Spotting these subtle relationships proves invaluable for crafting investment strategies in today's volatile markets. The depth of analysis available through these techniques provides investors with previously unavailable insights into company performance trajectories.

By examining enormous data volumes, these analytical methods detect correlations and outliers that human researchers might overlook. This granular understanding enables the creation of more refined investment approaches, potentially yielding superior returns while maintaining portfolio stability.

Improving Accuracy and Speed

Conventional equity analysis often involves labor-intensive manual processes prone to subjective interpretation. Contemporary analytical tools process information with remarkable speed and impartiality. In financial markets where timing is everything, this combination of rapid processing and objectivity becomes indispensable, allowing market participants to respond to evolving conditions with precision.

The dramatic acceleration of research workflows gives investors crucial advantages in identifying emerging market movements and managing exposure to potential risks more proactively.

Enhanced Due Diligence

Automated analysis systems comprehensively evaluate corporate financials, news coverage, market sentiment, and other critical indicators to assess company health and growth potential. This systematic approach ensures no important detail is missed during the evaluation process.

This rigorous examination leads to better-informed investment choices and helps avoid costly oversights. By synthesizing diverse data streams, these systems create more complete corporate assessments and improve forecasting accuracy for investment planning.

Predictive Modeling

Advanced computational models trained on historical market data can forecast security prices and market directions. These projections help identify promising investment scenarios. While not infallible, predictive analytics serve as powerful aids for anticipating market shifts and refining investment tactics. Recognizing potential market changes early allows for more strategic positioning.

Objective Insights and Bias Reduction

Algorithmic analysis eliminates the cognitive biases that often influence human judgment. By removing subjective interpretation, these systems deliver more impartial evaluations of market conditions and corporate performance, creating fairer investment landscapes. This neutral perspective contributes to more balanced decision-making processes across market ecosystems.

Eliminating human error and prejudice from analytical workflows produces more dependable insights, potentially leading to improved investment results and reduced market inequities.

AI-Driven Fixed Income Analysis: Navigating Complex Markets

Impact on Fixed Income Strategies

Advanced analytical methods are revolutionizing fixed income markets, enabling deeper analysis and more nuanced investment approaches. These techniques process enormous datasets, detect intricate patterns, and forecast market movements with precision surpassing conventional approaches. Investors gain clearer decision-making frameworks that may enhance returns while controlling risk exposure.

The ability to synthesize diverse data sources - including economic metrics, sentiment indicators, and credit assessments - provides comprehensive market perspectives. This holistic view helps identify undervalued instruments and potential hazards more effectively.

Machine Learning in Fixed Income Modeling

Sophisticated pattern recognition algorithms excel in fixed income applications. These systems learn from historical data to create predictive models for yield curves, rate changes, and credit differentials. These adaptive models continuously refine their outputs based on evolving market conditions, offering dynamic portfolio insights.

By detecting subtle historical patterns that traditional analysis might miss, these systems generate more nuanced forecasts, leading to better investment decisions.

Enhanced Portfolio Optimization

Modern portfolio construction tools analyze countless variables - from rate projections to credit risk assessments - to build optimally balanced portfolios matching specific investor profiles. These systems can dynamically rebalance holdings in response to shifting market landscapes, ensuring continuous alignment with investment objectives.

Predictive Analytics for Interest Rate Forecasting

Advanced modeling techniques excel at projecting interest rate movements by analyzing economic indicators like inflation data, growth metrics, and central bank policies. Accurate rate predictions enable timely portfolio adjustments to capitalize on favorable conditions while mitigating downside risks.

Credit Risk Assessment

Sophisticated algorithms evaluate creditworthiness by analyzing financial statements, industry dynamics, and macroeconomic factors. This comprehensive approach to credit analysis improves risk identification and management capabilities, helping investors make more informed bond selection decisions.

Real-time Monitoring and Adaptive Trading

Continuous market surveillance systems provide up-to-the-second updates on price movements and trend developments. This real-time data flow enables more responsive trading strategies and automated execution based on predefined parameters, reducing operational errors and improving efficiency.

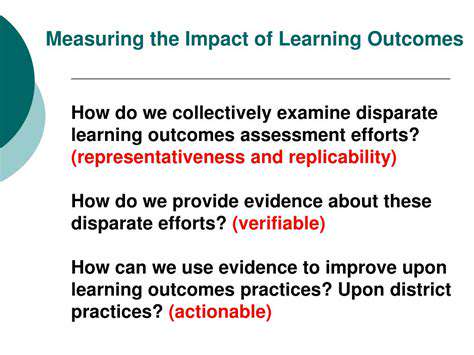

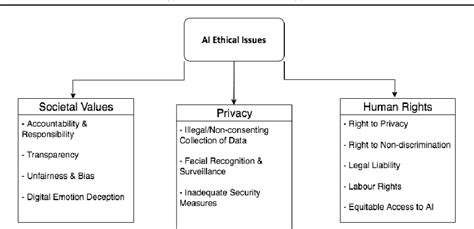

Ethical Considerations and Future Trends

While offering significant analytical advantages, these technologies require careful implementation to avoid potential pitfalls like data bias or market disruption. Maintaining transparency in algorithmic decision-making processes remains essential for sustaining investor confidence and market integrity.

Future developments will likely feature increasingly sophisticated analytical models, deeper data integration, and more accessible platforms for implementing these advanced investment strategies.

Optimizing Portfolio Construction with Advanced Analytics

Understanding Asset Allocation

A fundamental component of portfolio management involves strategic asset distribution across various investment categories. Proper allocation forms the foundation for risk management and return optimization. A diversified portfolio aligned with individual risk parameters and financial objectives supports long-term wealth accumulation.

Different investment categories exhibit distinct risk-return characteristics that must be understood in the context of personal circumstances. Thorough evaluation of these factors contributes to more informed investment choices and better portfolio construction.

Evaluating Risk Tolerance and Financial Goals

Accurate self-assessment of risk appetite represents a critical portfolio planning step. This honest evaluation of market volatility tolerance should reflect current financial situations and future obligations. Investment objectives ranging from retirement planning to education funding require tailored allocation strategies matching specific time horizons and liquidity needs.

Implementing Diversification Strategies

Portfolio resilience stems from thoughtful diversification across asset classes, sectors, and regions. This risk mitigation approach reduces dependence on any single investment while maintaining exposure to growth opportunities.

Effective diversification extends beyond broad asset categories to include sector and geographic considerations. Spreading investments across different industries helps buffer against sector-specific downturns while global exposure can capture growth in emerging markets. Understanding market interconnections enhances portfolio stability and performance potential.