The Rise of AI in Algorithmic Trading

The Fundamental Shift in Trading Strategies

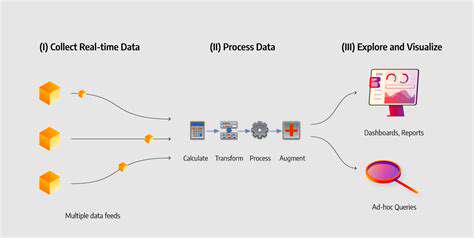

The integration of Artificial Intelligence (AI) into algorithmic trading is fundamentally altering how financial markets are navigated. Traditional, rule-based systems are giving way to more sophisticated strategies that can adapt to complex market dynamics in real-time. This shift is not merely about automating existing processes, but about leveraging AI's ability to identify subtle patterns and correlations that human traders might miss, leading to potentially more profitable and resilient trading strategies.

This evolution is driven by the exponential growth of data available to traders. AI algorithms can process vast datasets, including market trends, news sentiment, social media chatter, and economic indicators, to generate predictions and execute trades with unprecedented speed and precision.

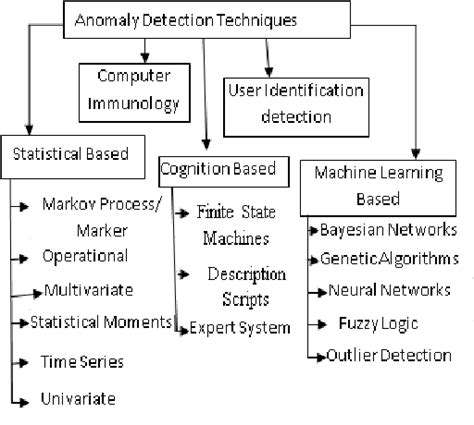

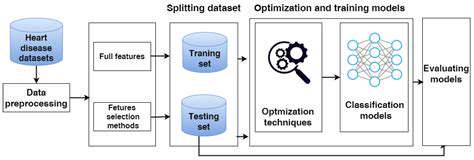

Harnessing Machine Learning for Predictive Modeling

Machine learning, a subset of AI, is playing a pivotal role in the development of sophisticated predictive models for algorithmic trading. By analyzing historical market data, machine learning algorithms can identify patterns and relationships that are too complex for traditional methods to detect. This allows algorithms to adapt and evolve their strategies based on new information, leading to more accurate predictions and potentially higher returns.

Different machine learning techniques, such as neural networks and support vector machines, are employed to build predictive models. These models can be trained on diverse datasets, allowing them to capture intricate relationships between various market factors and predict future price movements.

Enhanced Risk Management and Portfolio Optimization

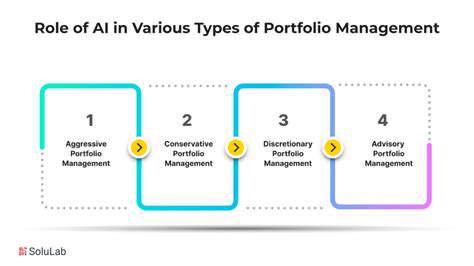

AI's ability to process vast amounts of data also enhances risk management capabilities in algorithmic trading. By analyzing market volatility, historical trading patterns, and other risk factors, AI algorithms can identify potential risks and adjust trading strategies accordingly, minimizing potential losses. This proactive approach to risk management is crucial in today's volatile financial markets.

Further, AI facilitates more sophisticated portfolio optimization. Instead of relying on rudimentary diversification strategies, AI algorithms can create portfolios that are tailored to specific risk profiles and investment goals, potentially maximizing returns while mitigating risks. This personalized approach to portfolio management is a significant advantage for investors seeking optimized returns.

The Impact on Trading Speed and Efficiency

AI's ability to process information at incredibly high speeds is revolutionizing the speed and efficiency of algorithmic trading. Algorithms can analyze market data, execute trades, and adapt to changing conditions in milliseconds, a feat previously impossible for human traders. This speed advantage is particularly crucial in high-frequency trading, where milliseconds can make a significant difference in profitability.

Ethical Considerations and Regulatory Challenges

The increasing use of AI in algorithmic trading raises important ethical considerations. Concerns about algorithmic bias, potential market manipulation, and the lack of transparency in AI-driven trading decisions need careful consideration. Robust regulatory frameworks are essential to ensure fair and equitable market practices in the age of AI.

Furthermore, the potential for unintended consequences from complex AI algorithms must be addressed. Understanding and mitigating these risks is crucial for maintaining market stability and investor confidence in the evolving landscape of AI-driven finance.

Optimizing Portfolio Management with AI

Understanding Portfolio Diversification

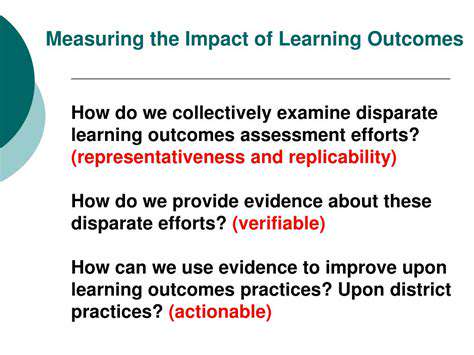

Portfolio diversification is a cornerstone of sound investment strategies. It involves spreading investments across different asset classes, industries, and geographies to mitigate risk. By not putting all your eggs in one basket, you reduce the impact of any single investment's poor performance on your overall portfolio. This strategy is crucial for long-term wealth preservation and growth, as it helps to smooth out the volatility inherent in the market. Diversification helps to balance risk and reward.

Assessing Risk Tolerance and Goals

A critical step in optimizing portfolio management is understanding your personal risk tolerance and financial goals. Investors with a higher risk tolerance can potentially achieve greater returns, but they also face a higher probability of losses. Conversely, those with a lower risk tolerance prioritize safety and preservation of capital. Identifying your time horizon—how long you intend to hold your investments—is equally important. A longer time horizon generally allows for greater risk-taking.

It's essential to align your investment strategy with your individual circumstances and aspirations. This means considering factors such as your age, income, family obligations, and retirement plans. Understanding your personal circumstances is crucial for developing a tailored investment plan.

Selecting Suitable Asset Allocation

A well-defined asset allocation strategy is essential for a successful portfolio. This involves determining the appropriate mix of different asset classes, such as stocks, bonds, real estate, and cash equivalents, within your portfolio. The ideal asset allocation depends on your risk tolerance, financial goals, and time horizon. A professional financial advisor can help you develop a suitable asset allocation strategy tailored to your specific needs. Careful consideration of your long-term financial objectives is key.

Implementing Effective Rebalancing Strategies

Market fluctuations can cause your portfolio's asset allocation to deviate from your target. Regular rebalancing is crucial to maintain your desired asset allocation and risk profile. This involves periodically adjusting your portfolio to bring it back to your target allocations. Consistent rebalancing helps to keep your portfolio aligned with your investment goals and risk tolerance. This process allows you to stay on track with your financial plan and maintain the desired risk level. Rebalancing can be done annually or more frequently as needed.

Monitoring and Adjusting the Portfolio

Continuous monitoring and adjustment of your portfolio are vital for long-term success. Market conditions and your personal circumstances can change over time, requiring adjustments to your strategy. Regularly reviewing your portfolio performance and making necessary adjustments is key to achieving your financial objectives. Regular reviews ensure that your investments remain aligned with your evolving financial goals and risk tolerance. You should actively monitor market trends and economic conditions. This will help you make informed decisions about your investments.