Revolutionizing Portfolio Construction with Quantum Algorithms

Understanding the Core Principles of Modern Portfolio Construction

Modern portfolio construction is more than just throwing assets together. It's a sophisticated process built on the foundation of diversification, risk assessment, and return expectations. Understanding your individual risk tolerance and financial goals is paramount. This involves meticulously analyzing your current financial situation, future aspirations, and any potential unforeseen circumstances. A well-constructed portfolio reflects a deep understanding of these fundamental principles, ensuring a robust and adaptable strategy.

By carefully evaluating your risk tolerance, you can align your investment choices with your comfort level. This avoids unnecessary stress and allows for a more sustainable investment journey. A well-defined risk tolerance also informs the appropriate asset allocation, ensuring your portfolio is balanced and resilient against market fluctuations.

The Role of Diversification in Portfolio Stability

Diversification is the cornerstone of a resilient portfolio. It involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and alternative investments. This strategy mitigates risk by reducing the impact of poor performance in any single asset or market segment. By diversifying, you effectively reduce the volatility of your overall portfolio, creating a more stable and predictable return profile.

Diversification is not just about the broad asset classes; it also extends to within those classes. For instance, within the stock market, diversifying across different sectors (technology, healthcare, consumer goods, etc.) and company sizes further enhances risk mitigation. This approach ensures that the portfolio's performance isn't overly influenced by the performance of a single sector or company.

Incorporating Alternative Investments for Enhanced Returns

Beyond traditional assets, alternative investments can play a crucial role in a well-rounded portfolio. These investments often include private equity, hedge funds, commodities, and real estate. Alternative investments can often provide diversification and potentially higher returns, but they also carry a higher degree of risk compared to traditional assets. Careful due diligence and a thorough understanding of these investment vehicles are essential.

The potential for higher returns is enticing, but it's important to remember that alternative investments often require substantial capital and specialized knowledge. They are not a one-size-fits-all solution and should be integrated into a portfolio with a clear understanding of their associated risks and potential rewards.

Tailoring Asset Allocation to Individual Financial Goals

A critical aspect of modern portfolio construction is tailoring the asset allocation to your specific financial goals. Whether it's retirement planning, funding a child's education, or achieving a specific financial milestone, your portfolio should reflect these objectives. A portfolio designed specifically for retirement will differ significantly from one focused on short-term goals. Careful consideration of these unique needs is paramount.

Implementing a Robust Risk Management Strategy

Risk management is an ongoing process, not a one-time event. Developing and implementing a robust risk management strategy is crucial for navigating market fluctuations and maintaining portfolio stability. This involves continuously monitoring market conditions, adjusting asset allocations as needed, and reassessing risk tolerance. Regular portfolio reviews are essential for staying aligned with your financial objectives and risk tolerance.

Understanding and managing market risk, credit risk, and liquidity risk is essential for long-term portfolio success. This proactive approach ensures that your portfolio remains adaptable and resilient in response to changing economic conditions and market trends.

The Importance of Ongoing Portfolio Monitoring and Rebalancing

A well-constructed portfolio isn't a static entity. Market conditions change, and individual circumstances evolve. Therefore, ongoing monitoring and rebalancing are essential for maintaining the desired asset allocation and risk profile. Regular portfolio reviews allow for adjustments based on market performance and your evolving financial goals. This proactive approach ensures your portfolio remains aligned with your objectives and risk tolerance.

Regular rebalancing ensures that your portfolio doesn't become too heavily weighted in one particular asset class. It's about maintaining the desired balance and maximizing your potential returns while minimizing unnecessary risk.

Quantum Monte Carlo Simulation for Enhanced Risk Assessment

Quantum Monte Carlo Methods

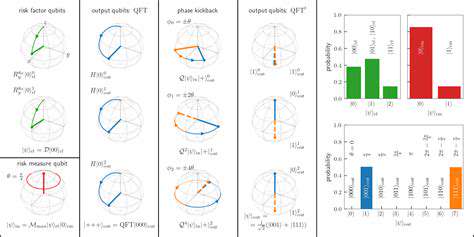

Quantum Monte Carlo (QMC) methods are powerful computational techniques used to simulate quantum systems. These methods leverage statistical sampling techniques to estimate properties of quantum systems, such as ground-state energies, wave functions, and other expectation values. They are particularly useful for systems with many interacting particles where analytical solutions are intractable. The core idea is to generate random samples from the probability distribution associated with the system's wave function, allowing us to obtain accurate estimates of the desired quantities.

QMC methods offer a unique approach to tackling complex quantum mechanical problems. They avoid the need for explicit solutions to the Schrödinger equation, making them applicable to a wider range of systems and configurations. This is a significant advantage compared to other computational techniques, which often have limitations in terms of system size or complexity.

Importance Sampling

A crucial aspect of QMC simulations is the use of importance sampling. This technique involves modifying the probability distribution to enhance the sampling of regions of the configuration space that are more relevant to the desired quantities. By strategically adjusting the sampling weights, we can improve the efficiency and accuracy of the simulation. This targeted sampling allows the algorithm to focus on the most important contributions to the calculated properties.

Variational Monte Carlo (VMC)

Variational Monte Carlo (VMC) is a type of QMC method used to estimate the ground-state energy of a quantum system. It involves constructing a trial wave function, which is an approximation to the true ground-state wave function. By sampling from this trial wave function, we can calculate the expected energy and optimize the trial wave function to minimize this energy. The resulting estimate of the ground-state energy provides a lower bound on the true ground-state energy.

This method offers a valuable technique to approximate complex quantum systems. By using a trial wave function, we can efficiently explore a vast configuration space to find a lower bound on the ground-state energy.

Diffusion Monte Carlo (DMC)

Diffusion Monte Carlo (DMC) is a powerful QMC method used to obtain more accurate estimates of the ground-state wave function and energy. It builds upon the ideas of VMC by incorporating a diffusion process that helps guide the sampling towards the true ground state. DMC can provide very accurate results for systems with strong correlations. By simulating the quantum diffusion of particles, DMC can extract highly precise ground-state properties.

Quantum Chemical Applications

QMC methods have found wide applications in quantum chemistry. They are particularly useful for studying molecular systems with many electrons, where the complexities of electron-electron interactions are significant. These methods allow for the investigation of molecular properties, such as equilibrium geometries, vibrational frequencies, and reaction pathways. Their ability to handle electron correlation makes them valuable tools for understanding chemical phenomena.

Computational Resources and Challenges

QMC simulations, while powerful, can be computationally demanding, especially for large and complex systems. Significant computational resources, including high-performance computers, are often required to achieve accurate results. The computational cost scales with the system size and the desired accuracy. Additional challenges include the need for careful parameter selection and analysis of the results to ensure reliability.

Future Directions

Ongoing research in QMC methods focuses on developing more efficient algorithms and improving the accuracy of calculations. This includes exploring new sampling techniques and developing sophisticated trial wave functions. Future developments aim to address the computational limitations of current methods and expand the applicability of QMC to even more complex quantum systems. Progress in these areas will lead to a deeper understanding of fundamental physical processes. The ultimate goal is to expand the scope of these methods to tackle larger and more challenging problems in materials science, condensed matter physics, and beyond.