AI-Powered Portfolio Optimization

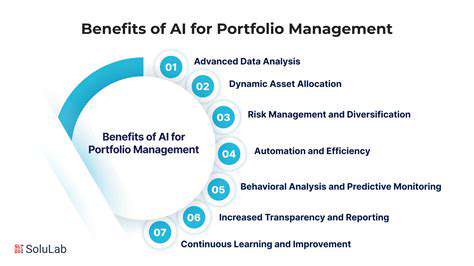

Modern investment algorithms have evolved far beyond simple buy-and-hold approaches, now enabling advanced portfolio optimization techniques. These systems process enormous datasets, blending market movements, economic signals, and individual risk profiles to make continuous portfolio adjustments. This adaptive method creates investment strategies that are uniquely suited to each investor's needs while potentially delivering superior performance. The real-time nature of these adjustments is particularly valuable as financial markets exist in a constant state of flux, requiring immediate responses to maintain ideal risk levels and seize new opportunities.

Unlike traditional analysis, these advanced tools can uncover hidden value in assets and spot potential dangers that might escape human attention. This forward-looking perspective proves essential for sustained success in today's rapidly changing investment environment. The systems go beyond basic asset distribution, integrating nuanced elements like emotional tone in financial news or social media discussions to sharpen investment choices. Such sophisticated analysis provides clear benefits compared to conventional investment approaches.

Predictive Analytics for Market Forecasting

Forecasting financial markets has entered a new era thanks to AI's predictive abilities. By examining past market behavior, detecting patterns, and weighing external influences, these models produce remarkably precise forecasts about future market directions. Investors can use these insights to prepare for potential market downturns or upswings, adjusting their positions in advance. This predictive capacity becomes particularly valuable during periods of market instability, helping to minimize losses while identifying promising opportunities.

AI systems go far beyond elementary trend spotting, capable of unraveling intricate connections between diverse market signals. This sophisticated analysis can expose subtle relationships and forecast market shifts with impressive accuracy. Such advanced predictive capabilities benefit not just individual investors but also major financial institutions managing substantial portfolios. Moreover, the technology's ability to sift through massive datasets reveals minute patterns that would elude even the most experienced human analysts.

Enhanced Due Diligence and Risk Management

The investment evaluation process has been revolutionized by AI technology. By processing financial reports, corporate updates, and sector developments, these systems can pinpoint potential issues and opportunities with unprecedented efficiency. This thorough examination supports better investment choices while reducing expensive mistakes. The automated nature of this analysis dramatically accelerates the evaluation timeline, allowing investors to respond to market changes with remarkable speed - a critical advantage in today's rapid-fire financial environment.

Beyond simple risk identification, these systems can precisely measure each investment's risk level. This enables a more refined risk management approach, helping investors build portfolios that perfectly match their comfort with risk. By translating risk into concrete numbers, these tools promote more logical, data-driven investment decisions.

Additionally, the technology provides ongoing surveillance of investment positions, identifying and warning about potential issues as they emerge. This preventative approach to risk control helps avoid losses and ensures portfolio stability over time. Such real-time monitoring offers substantial benefits compared to traditional risk management techniques.

AI-Driven Market Prediction and Analysis

AI's Impact on Market Forecasting

The financial sector is experiencing profound changes as artificial intelligence transforms market prediction capabilities. Advanced algorithms trained on massive datasets can detect intricate patterns and connections within market information that human analysts would likely miss. This remarkable ability leads to more precise and timely forecasts, potentially revolutionizing investment approaches and corporate strategies.

AI's greatest strength in market forecasting lies in its capacity to analyze enormous data volumes while identifying subtle trends that might otherwise go unnoticed. Conventional analysis methods often become overwhelmed by today's data deluge, struggling to find meaningful signals in the noise. AI systems, by contrast, can process and interpret this information with stunning speed and accuracy, providing a more complete understanding of market behavior.

Data Sources for AI-Powered Predictions

Effective predictive models draw from numerous information streams. These include historical price data, economic measurements, public sentiment from social platforms, financial journalism, and even meteorological data. By synthesizing these varied inputs, AI systems develop a richer comprehension of market forces, resulting in more sophisticated and dependable forecasts.

The quality of predictions depends heavily on incorporating diverse, high-quality data sources. When models incorporate a wide spectrum of information, they can form a more accurate market picture, reducing errors that stem from limited or skewed datasets.

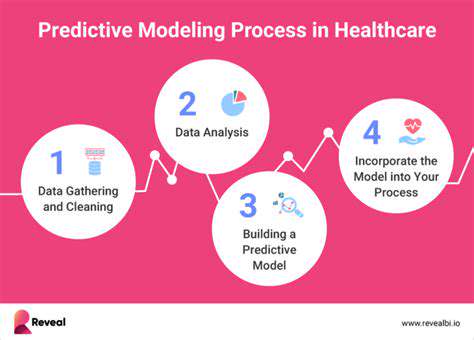

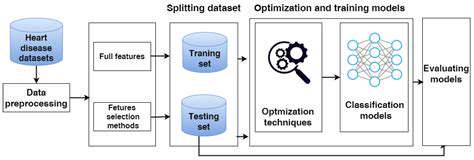

Methods of AI-Driven Forecasting

Market prediction employs various AI techniques, including machine learning approaches like predictive modeling, categorization, and pattern grouping. These methods identify historical relationships to anticipate future market behavior. More advanced solutions such as deep neural networks can further improve prediction accuracy by detecting complex patterns in multifaceted datasets.

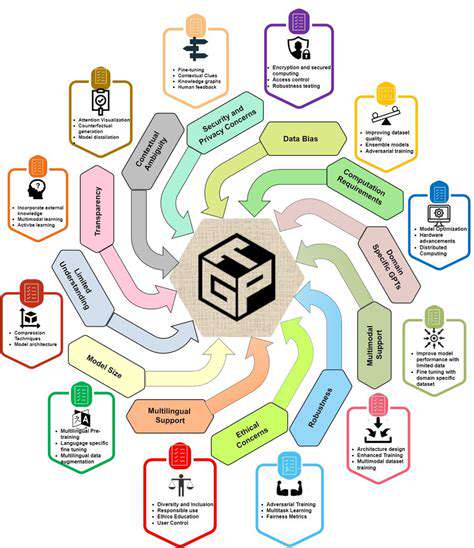

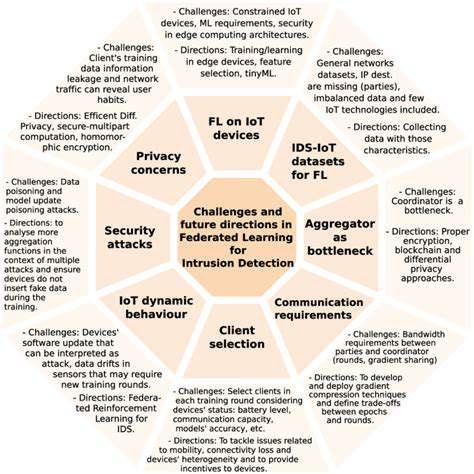

Challenges in AI Market Prediction

Despite its promise, AI-based market forecasting encounters several obstacles. A primary difficulty involves securing sufficient high-quality training data. Inferior data leads to unreliable predictions, making it essential to verify that training information is accurate, thorough, and unbiased. Another challenge stems from markets' inherent complexity, which can be difficult to model effectively.

Protecting sensitive financial data presents another major consideration. Since AI models depend on confidential market information, ensuring data security and preventing misuse remains paramount for maintaining industry trust.

Accuracy and Reliability of AI Forecasts

The investment community continues to assess the precision and dependability of AI-generated market predictions. Continuous refinement and testing remain crucial for improving model accuracy. Thorough evaluation processes help verify model performance across different market scenarios, ensuring reliable outputs for decision-makers.

While AI shows tremendous potential, predictions should never be considered certainties. Markets can behave unpredictably, and unexpected developments may disrupt even the most advanced models. Investors should treat AI forecasts as valuable decision-support tools rather than infallible prophecies.