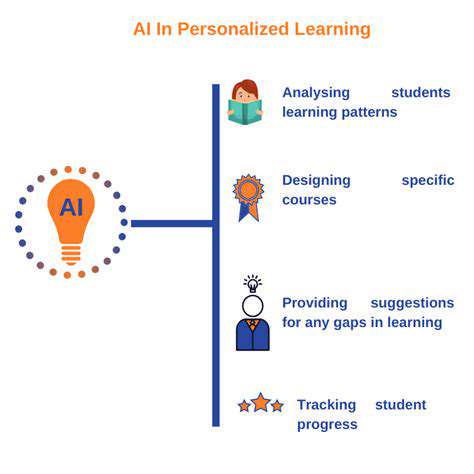

Contemporary machine learning platforms show remarkable aptitude for analyzing intricate healthcare data, detecting nuanced relationships that frequently elude human analysts. This analytical power facilitates predicting health trajectories and potential clinical outcomes across diverse medical situations. The transformative potential of these systems stems from their ability to extract meaningful patterns from historical patient data and project future care requirements. Such predictive capacity enables healthcare providers to initiate preventive measures and refine treatment approaches.

Challenges and Considerations in Implementation

Data Integration Challenges

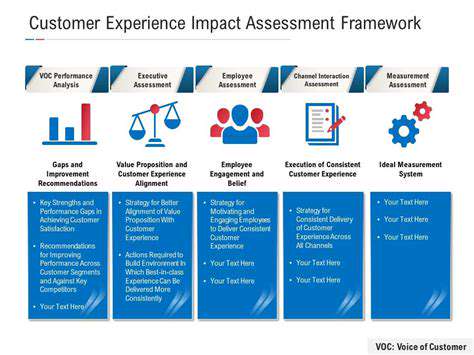

Financial organizations face substantial obstacles when attempting to unify diverse data sources for automation initiatives. The typical institution operates multiple legacy platforms, each with unique data structures and protocols. Creating seamless data flows between these systems demands extensive preparatory work in data standardization and quality assurance, often resulting in project delays and budget overruns that can undermine the business case for automation.

Data integrity emerges as a critical concern, as automated systems are only as reliable as the information they process. Inconsistent or inaccurate data can produce misleading results, potentially compromising decision-making quality. Implementing comprehensive data governance frameworks becomes essential, though this often requires substantial investments in both technology infrastructure and personnel training.

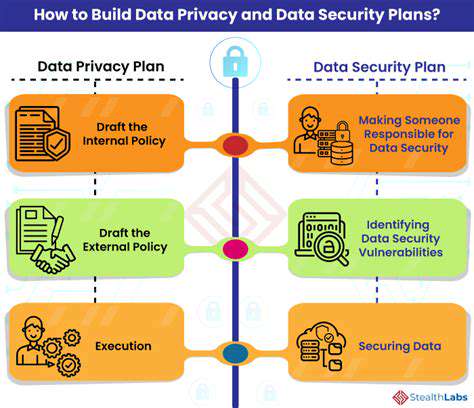

Security and Compliance Concerns

Deploying automation in financial environments introduces significant security considerations. Protecting sensitive financial data and transaction integrity requires implementing multilayered security measures that meet rigorous standards like GDPR and PCI DSS. This necessitates continuous security monitoring, advanced encryption methods, strict access controls, and regular penetration testing to identify and address potential vulnerabilities.

The regulatory landscape adds another layer of complexity, as compliance requirements continue to evolve. Automation systems must be designed with sufficient flexibility to accommodate regulatory changes, creating an ongoing maintenance burden that institutions must factor into their long-term planning.

Scalability and Maintainability

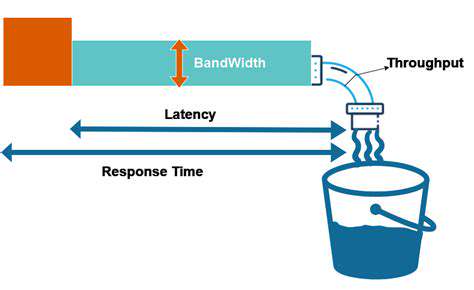

Effective automation solutions must be architectured to accommodate future growth in transaction volumes and data processing requirements. This foresight in system design becomes particularly crucial as institutions expand their digital operations. Many organizations are turning to cloud-based solutions that offer elastic scalability, though this approach introduces its own set of integration and management challenges.

Talent Acquisition and Training

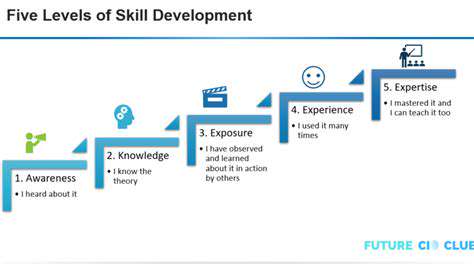

The shift to automated operations creates demand for professionals with hybrid skill sets combining financial expertise with technical knowledge. Institutions must invest significantly in upskilling programs to help existing staff adapt to new operational paradigms while simultaneously competing for scarce talent in fields like data science and AI development. This human capital challenge represents one of the most significant barriers to successful automation implementation.

Change Management and Employee Adoption

Workforce adaptation to automated environments presents substantial organizational challenges. Employees often experience anxiety about job security and role changes when automation is introduced. Successful implementation requires comprehensive change management programs that address these concerns through transparent communication, targeted training initiatives, and clear articulation of how automation will augment rather than replace human roles.

Cost and Return on Investment (ROI)

The financial commitment required for automation projects can be substantial, encompassing not just technology acquisition but also system integration, process redesign, and workforce retraining. Institutions must conduct rigorous cost-benefit analyses that account for both tangible efficiencies and strategic advantages like improved customer retention and competitive positioning. The ROI calculation becomes particularly complex when considering long-term transformation rather than immediate efficiency gains.

Ethical Considerations and Bias Mitigation

Automation systems can inadvertently perpetuate and amplify biases present in their training data, creating significant ethical concerns in financial services where equitable treatment is paramount. Institutions must implement robust bias detection mechanisms and continuously monitor algorithmic decision-making for discriminatory patterns. This requires ongoing investment in model validation and the development of ethical AI frameworks that align with both regulatory requirements and corporate values.