AI-Powered Pattern Recognition for Fraud Detection

Advancements in AI's Pattern Detection Capabilities

The evolution of artificial intelligence has brought remarkable improvements in detecting intricate patterns within massive data collections. This technological breakthrough is reshaping multiple sectors, ranging from healthcare diagnostics to economic forecasting. Modern AI systems demonstrate exceptional skill in identifying subtle correlations and complex interactions that frequently escape human detection. Such capabilities enable more precise forecasts and better-informed choices across various applications.

Industry-Specific Implementations

The utilization of pattern recognition through AI demonstrates significant value across numerous sectors. Medical professionals employ these systems to examine diagnostic imagery, spotting irregularities such as malignant growths with enhanced precision and efficiency. This advancement facilitates quicker medical interventions and substantial improvements in patient outcomes. Financial institutions leverage similar technology to uncover suspicious activities and anticipate economic shifts, thereby strengthening security protocols and financial performance.

Harnessing Extensive Data Processing

The true potential of AI emerges from its capacity to handle enormous information quantities. This feature proves indispensable for uncovering concealed patterns within complex datasets. Through comprehensive data examination, artificial intelligence reveals critical insights that would remain inaccessible through conventional analysis methods, driving transformative progress across multiple disciplines.

Ethical Implications and Technical Hurdles

Despite impressive achievements in pattern identification, significant ethical concerns and technical obstacles remain. Maintaining impartial and precise AI-generated conclusions represents a persistent challenge. Potential prejudices within training materials could produce skewed results, while the possibility of technology misuse requires careful consideration. Comprehensive policy guidelines and moral standards must govern AI implementation to ensure responsible technological advancement.

Emerging Developments and Prospects

The trajectory of AI-assisted pattern analysis indicates substantial future growth across multiple dimensions. Breakthroughs in neural network architectures continue expanding the technology's capacity for sophisticated pattern identification. Moreover, combining artificial intelligence with complementary innovations like interconnected sensor networks will unlock novel possibilities for large-scale data examination. These developments promise to stimulate groundbreaking progress in various commercial and scientific fields.

Essential Human Supervision

While AI demonstrates remarkable analytical abilities, continuous human involvement remains indispensable. These systems should function as supplementary tools rather than complete replacements for human judgment. Human professionals provide crucial interpretation of AI-generated findings and ensure ethical implementation of technological solutions. Optimal results emerge from collaborative efforts combining human experience with machine processing capabilities.

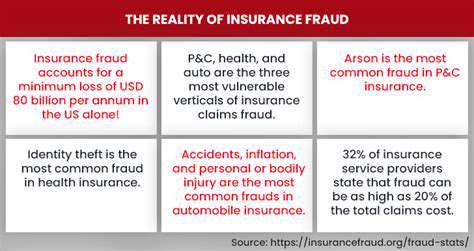

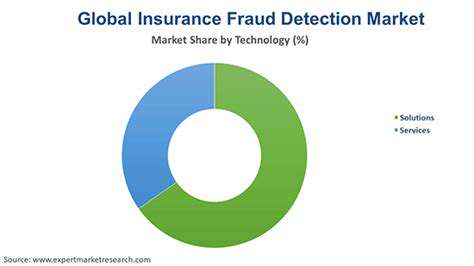

Big Data's Contribution to AI-Based Fraud Analysis

Fundamental Data Requirements for Fraud Identification

Extensive datasets form the foundation for artificial intelligence applications in insurance fraud scrutiny. These comprehensive collections include diverse information types, ranging from client profiles and previous claim records to financial transaction specifics and economic indicators. Conventional fraud detection methods frequently struggle with the quantity, speed, and diversity of modern data streams. AI-based systems demonstrate superior performance in evaluating these complex information repositories, detecting irregularities and suspicious patterns that might escape manual review.

Data integrity and consistency represent critical factors for successful implementation. Imperfect, contradictory, or incorrect information can generate flawed fraud detection models, potentially causing incorrect identifications or overlooked fraudulent cases. Rigorous data management protocols and thorough cleansing procedures ensure the dependability of information utilized in AI-powered analytical systems.

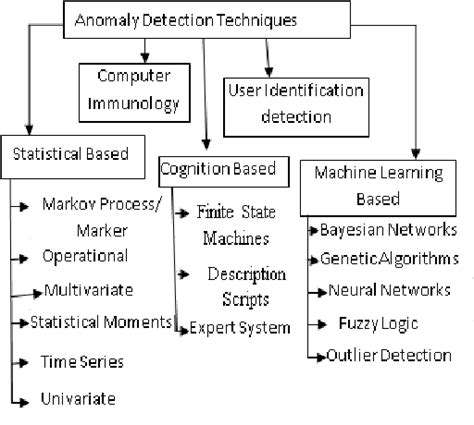

Pattern Identification through Machine Learning

Automated learning systems serve as the backbone of contemporary fraud analysis. These computational models undergo extensive training using historical datasets to recognize characteristics associated with fraudulent behavior. Classification techniques including predictive probability models and multidimensional separation algorithms commonly distinguish between legitimate and suspicious transactions.

Alternative approaches like data grouping methods can uncover unusual configurations representing emerging fraud tactics. Selection of appropriate analytical models depends on specific insurance data attributes and targeted fraud categories under investigation.

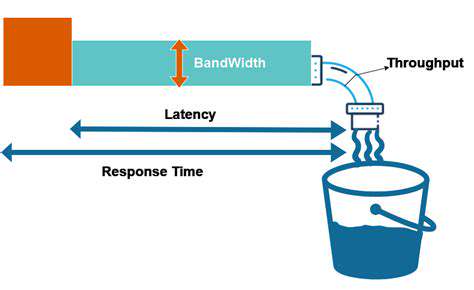

Instantaneous Fraud Monitoring

A key benefit of AI in fraud examination involves the capacity for immediate detection of suspicious activities. Continuous surveillance of financial operations coupled with automated analysis enables prompt identification of potentially fraudulent transactions, minimizing financial exposure.

Proactive Fraud Risk Assessment

Beyond simple detection, AI systems can forecast probable fraudulent incidents before they occur. By evaluating historical patterns and identifying risk markers, predictive models estimate the probability of dishonest claims, enabling preemptive countermeasures.

These forecasting tools assist insurance providers in resource allocation, concentrating efforts on high-risk clients and transactions more likely to involve deception. This focused strategy can substantially decrease fraud-related expenses while enhancing detection efficiency.

Enhancing Precision and Minimizing Errors

A crucial consideration in AI-based fraud scrutiny involves reducing incorrect fraud alerts. Mistaken flags can prompt unnecessary inquiries and disrupt valid business operations. Contemporary algorithmic refinements continue improving model accuracy, decreasing false alarms while maintaining effective identification of genuine fraudulent cases.

Combining Automated and Human Analysis

While AI significantly accelerates fraud detection processes, professional human insight remains invaluable. Artificial intelligence functions most effectively as an enhancement to, rather than replacement for, experienced analysts. Human professionals contribute essential contextual understanding, recognize subtle indicators, and address sophisticated fraud situations requiring nuanced interpretation.

Optimal fraud prevention strategies combine machine processing capacity with human expertise, creating a synergistic approach that improves overall detection effectiveness and operational efficiency.