Beyond Transactional Analysis: AI's Role in Customer Behavior Analysis

Understanding Customer Needs through AI

Modern AI systems can process enormous datasets of customer information, encompassing purchase patterns, online navigation habits, and social media engagement, to uncover meaningful trends that expose fundamental customer desires and decision-making processes. This advanced processing capability extends far beyond basic purchase recognition, exploring the psychological drivers behind consumer choices. When businesses comprehend these underlying factors, they can customize offerings to better align with customer expectations, building more authentic and lasting connections.

This refined grasp of consumer psychology enables hyper-targeted promotional initiatives, precision product innovation, and enhanced client support frameworks. In today's volatile marketplace, such insights allow organizations to predict and meet customer demands before they're explicitly expressed.

Predicting Customer Behavior with Machine Learning

Sophisticated machine learning models excel at forecasting upcoming customer actions. By detecting recurring sequences in past transactional data, these systems can accurately project account abandonment risks, future buying probabilities, and even potential service grievances before they surface. This forward-looking strategy empowers businesses to implement preemptive solutions, mitigating negative impacts on customer satisfaction and financial performance.

Personalized Customer Experiences through AI

Contemporary AI facilitates the delivery of bespoke customer journeys. Through meticulous analysis of individual consumer profiles, these systems can customize product suggestions, promotional content, and support conversations to match each person's distinctive tastes. This degree of customization cultivates stronger emotional connections and perceived worth, directly translating to improved retention rates.

Consider the experience of receiving merchandise suggestions that perfectly complement previous acquisitions and browsing patterns. Such individualized attention doesn't merely improve the shopping experience - it dramatically boosts the probability of continued patronage.

Improving Customer Service Efficiency

Advanced conversational AI solutions can manage substantial volumes of routine customer queries, allowing human representatives to concentrate on nuanced, high-value interactions. This operational streamlining results in quicker resolution times, heightened satisfaction levels, and significant organizational cost efficiencies. By automating repetitive tasks, these systems enable customer care teams to focus on building meaningful relationships.

Identifying Fraudulent Activities with AI

Modern anomaly detection systems excel at uncovering potentially fraudulent patterns. Through continuous examination of transactional behaviors, identification of irregular spending profiles, and real-time risk flagging, these technologies provide powerful safeguards against financial crimes. In an era of sophisticated digital fraud schemes, such protective measures have become indispensable for maintaining transaction integrity.

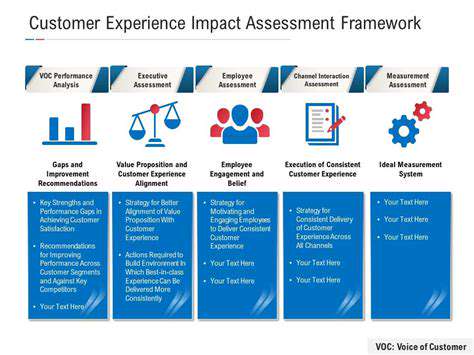

Analyzing Customer Sentiment and Feedback

Natural language processing tools can interpret customer evaluations, survey responses, and social commentary to assess overall satisfaction levels and pinpoint improvement opportunities. This emotional intelligence capability gives companies unprecedented visibility into consumer perspectives, enabling rapid issue resolution and evidence-based enhancements across all touchpoints.

Optimizing Marketing Strategies with AI Insights

Contemporary AI platforms can evaluate promotional campaign effectiveness moment-by-moment, delivering actionable intelligence about performance metrics. This analytical approach facilitates immediate tactical adjustments, ensuring optimal resource allocation and maximum campaign ROI. By identifying the most productive channels, audience segments, and communication styles, these systems guarantee marketing efforts resonate with their intended targets.

The Future of Banking Security: AI-Driven Proactive Defense

Strengthening Authentication Protocols

Next-generation banking security demands advanced verification methods that transcend conventional password systems. Biometric validation techniques using fingerprint scanning, facial geometry analysis, or vocal pattern recognition offer substantially improved protection by creating unique digital signatures. These physiological identifiers prove exponentially more challenging to duplicate or bypass compared to traditional alphanumeric credentials.

Layered authentication frameworks represent another essential safeguard. Mandating multiple confirmation steps - such as one-time mobile codes or hardware security keys - creates additional defensive barriers. This cumulative security model makes unauthorized access attempts virtually impossible, even if initial credentials become compromised.

Enhancing Data Encryption and Protection

State-of-the-art encryption forms the foundation of modern financial data protection. Implementing military-grade cryptographic protocols, particularly those employing end-to-end encryption standards, ensures sensitive information remains indecipherable to unauthorized parties. These measures are particularly critical for securing digital transactions and personal account details.

Comprehensive network security solutions including behavior-based intrusion prevention systems and adaptive firewalls provide continuous monitoring capabilities. These technologies automatically detect and neutralize suspicious activities, enabling security personnel to respond to threats in real-time.

Defending against advanced persistent threats requires a multi-layered security posture that combines technological solutions with user education. This dual approach addresses both technical vulnerabilities and human factors in cybersecurity.

The Role of Artificial Intelligence in Security

AI-powered security platforms are revolutionizing financial protection through predictive analytics and intelligent threat anticipation. These systems process enormous volumes of transactional data to identify subtle patterns that may indicate fraudulent behavior, allowing institutions to intercept criminal activities before they cause damage.

Self-learning algorithms continuously evolve by analyzing historical attack patterns, creating increasingly sophisticated defense mechanisms that adapt to emerging threats. This dynamic capability provides financial institutions with a decisive advantage against constantly evolving cybercriminal tactics.

The Importance of Customer Education and Awareness

Financial literacy initiatives play a critical role in comprehensive security strategies. Banks must actively educate clients about digital safety best practices, including creating robust credentials, identifying social engineering attempts, and reporting suspicious communications.

Equipping customers with practical security knowledge transforms them into active participants in fraud prevention efforts. This includes providing digestible educational materials and establishing straightforward reporting procedures.

Ongoing cybersecurity awareness programs significantly reduce vulnerability to phishing and similar deceptive attacks. By teaching customers to recognize common fraud indicators, financial institutions create a more secure ecosystem for all stakeholders.