Optimized Client Interactions and Operational Effectiveness

Customized Coverage Suggestions

Sophisticated algorithms process extensive datasets, incorporating client profiles, threat analyses, and industry movements to produce bespoke insurance recommendations. This tailored strategy supersedes generic offerings, fitting both coverage and pricing to exact situations. For instance, the system might propose elevated deductibles for inexperienced motorists while extending thorough protection to seasoned drivers with exemplary records. Such precision dramatically improves customer satisfaction by presenting options that genuinely match individual circumstances.

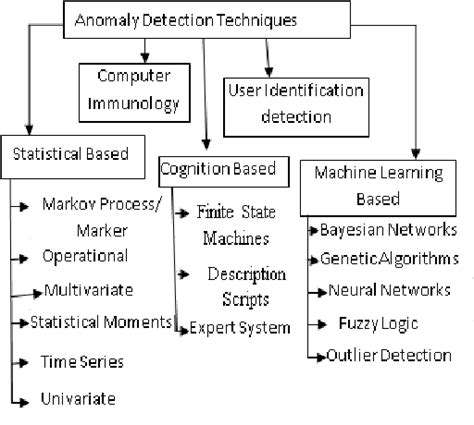

The capacity to forecast potential liabilities and offer preemptive suggestions represents a major advantage. Analytical systems detect subtle correlations that might elude human analysts, potentially averting future claims and generating savings for all parties. This forward-looking methodology substantially boosts operational productivity throughout the insurance value chain.

Streamlined Policy Administration

Automated systems now handle numerous policy management functions, spanning enrollment to claims resolution. This mechanization simplifies procedures, cuts bureaucratic hurdles, and enhances overall productivity. Policyholders can review agreements, process payments, and initiate claims through user-friendly digital platforms, removing the necessity for protracted telephone consultations or cumbersome paperwork.

Expedited Claims Resolution

Initial claim evaluations now occur with unprecedented speed through automated analysis of visual evidence, documentation, and supplementary information. This automation slashes processing durations while accelerating client reimbursements. Fraud detection capabilities have likewise improved substantially, strengthening insurers' risk containment measures.

By minimizing human involvement in routine claim assessments, providers dramatically reduce turnaround times, boost client contentment, and redirect personnel toward more intricate cases requiring human judgment.

Round-the-Clock Support Solutions

Intelligent virtual assistants deliver uninterrupted customer service, addressing common queries, navigating policyholders through claims procedures, and resolving straightforward concerns. This instantaneous support eradicates waiting periods while guaranteeing prompt assistance. These systems also aggregate and interpret client input, enabling continuous enhancement of products and services within a client-focused operational framework.

The capacity to comprehend and address diverse inquiries - including nuanced or complicated matters - elevates overall support quality, resulting in heightened client retention and brand allegiance.