Personalized Retirement Projections and Strategies

Understanding Your Retirement Needs

Personalized retirement projections are crucial for navigating the complexities of financial planning. These projections go beyond simple calculations and delve into the specific circumstances of each individual. They take into account factors such as current income, expenses, desired lifestyle in retirement, estimated lifespan, and potential market fluctuations. This detailed analysis allows for a more realistic and tailored approach to retirement planning, ensuring that individuals are well-prepared for the financial demands of their golden years.

Accurate estimations of future income needs are fundamental. These projections consider potential changes in inflation, healthcare costs, and personal spending patterns over time. By anticipating these variables, individuals can make informed decisions about saving and investment strategies, ensuring a comfortable and secure retirement.

Tailoring Investment Strategies

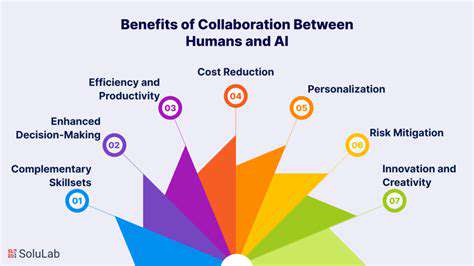

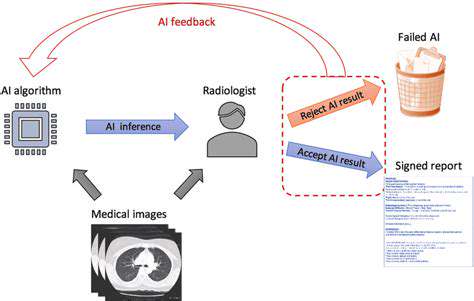

A personalized approach to retirement planning involves tailoring investment strategies to align with individual risk tolerance and financial goals. AI-powered financial advisory tools can analyze an individual's risk profile and investment history to recommend suitable asset allocation strategies. This ensures that investments are optimized for maximizing returns while mitigating potential risks. By identifying and adapting to market fluctuations, these tools can further refine investment strategies for consistent growth and stability throughout retirement.

These tailored investment strategies are crucial for long-term financial security. They consider factors like time horizon, market conditions, and individual preferences. By dynamically adjusting to these factors, AI can help individuals make informed investment choices that align with their specific retirement goals, maximizing potential returns and minimizing risks.

Developing a Retirement Budget

Creating a detailed retirement budget is another key aspect of personalized retirement planning. AI can analyze historical spending patterns and project future expenses, helping individuals anticipate and prepare for potential increases in healthcare costs or lifestyle changes. This proactive approach empowers individuals to make informed decisions about saving and investment strategies to ensure their retirement budget aligns with their desired lifestyle.

Managing Retirement Income Streams

Planning for retirement income involves more than just investments. AI-driven tools can analyze various income streams, including pensions, social security benefits, and other sources of retirement income. This comprehensive analysis allows individuals to understand the overall income picture and identify any potential gaps or shortfalls in their retirement income plans. This proactive approach helps to address potential financial challenges early on and refine strategies to ensure a stable and secure income stream.

By incorporating multiple income streams into the overall plan, AI can help individuals optimize income distribution, ensuring adequate funds for different aspects of their retirement. This personalized approach helps individuals create a more robust and adaptable retirement income strategy, accounting for potential changes in income sources and expenses.

Adapting to Market Fluctuations

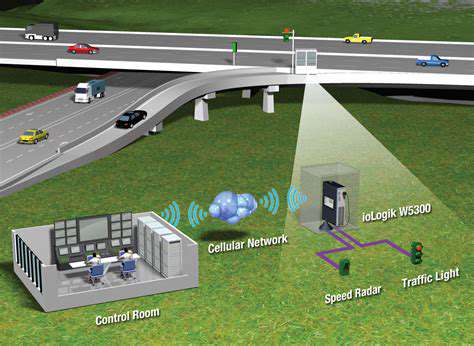

Retirement projections and strategies must be dynamic, adapting to market fluctuations and unforeseen circumstances. AI algorithms can monitor market trends and adjust investment strategies accordingly, ensuring that portfolios remain aligned with individual risk tolerance and financial goals. This proactive approach allows individuals to mitigate the impact of market volatility on their retirement savings and maintain a steady path towards their retirement objectives.

AI's ability to analyze market trends and predict potential risks allows for more informed and proactive adjustments to investment strategies. This proactive approach is vital for maintaining financial stability and achieving desired retirement outcomes, regardless of market conditions.

Automated Portfolio Management and Risk Assessment

Automated Portfolio Management: A Revolution in Investing

Automated portfolio management systems are transforming the investment landscape, offering investors unprecedented access to diversified and potentially higher-performing portfolios. These systems leverage sophisticated algorithms and data analysis to execute trades and rebalance portfolios automatically, freeing up investors from the time-consuming and often emotionally driven decision-making involved in traditional portfolio management. This automation significantly reduces the risk of human error and emotional biases that can negatively impact investment returns. By consistently adhering to pre-defined strategies, automated systems can foster more disciplined and rational investment approaches.

The key advantage lies in the efficiency and consistency of automated systems, allowing for a more disciplined approach to investing. This can be particularly valuable for investors with limited time or expertise in the financial markets. Automated portfolio management platforms often provide comprehensive investment tools, including risk assessments, portfolio tracking, and performance reporting, all within a user-friendly interface.

Key Features and Benefits of Automated Systems

Automated portfolio management systems typically offer a range of features designed to enhance the investment experience. These systems often include sophisticated algorithms for identifying investment opportunities and executing trades, enabling investors to maintain a diversified portfolio aligned with their risk tolerance and financial goals. Furthermore, they provide real-time portfolio monitoring and reporting, giving investors a clear understanding of their investment performance and any needed adjustments.

Investors can benefit from automated portfolio management systems in several ways. These systems can significantly reduce the risk of emotional decision-making in investments, fostering a more disciplined and consistent investment approach. Furthermore, the automated execution of trades can minimize transaction costs and improve overall portfolio returns. The automation also allows for dynamic adjustments to the portfolio based on market conditions and evolving investor goals.

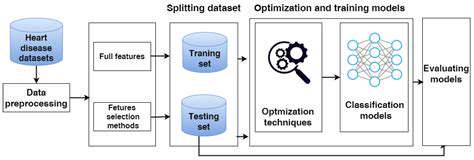

Algorithmic Strategies and Portfolio Optimization

The heart of automated portfolio management lies in the sophisticated algorithms that drive the system's decision-making. These algorithms analyze market data, assess risk factors, and execute trades based on predefined investment strategies. Different algorithms can be employed to achieve various investment goals, from capital preservation to aggressive growth. The key is to choose an algorithm that aligns with the investor's specific financial objectives and risk tolerance.

Portfolio optimization is another critical aspect of automated systems. These systems use mathematical models to construct portfolios that maximize returns while minimizing risk, based on the investor's specific requirements. This process involves considering various factors such as asset allocation, correlation between assets, and individual security characteristics to create a balanced and optimized portfolio.

Integration and User Experience

Modern automated portfolio management systems are designed with user-friendliness in mind. Most platforms offer intuitive interfaces that allow investors of all experience levels to easily navigate and manage their portfolios. This accessibility is crucial for widespread adoption and user engagement. Effective integration with other financial tools and platforms is also a critical component for a seamless user experience.

The user experience plays a vital role in investor satisfaction and continued use of automated portfolio management systems. A well-designed platform should provide clear and concise information about investment performance, portfolio diversification, and any necessary adjustments. A user-friendly interface empowers investors to actively participate in the management of their portfolio while leveraging the efficiency and consistency of automated processes.

The Future of Automated Portfolio Management

The future of automated portfolio management appears promising, with ongoing advancements in technology and investment strategies. As artificial intelligence and machine learning become more sophisticated, automated systems will likely become even more precise in their investment decisions, potentially leading to superior returns for investors. This further development will likely make these systems more accessible and affordable for a wider range of investors.

Further integration with other financial tools and platforms will likely streamline the overall investment process, making it more convenient and efficient for both individual and institutional investors. The continuous evolution of technology promises a more personalized and tailored approach to automated portfolio management, paving the way for a new era of investment efficiency and potential success.

The Future of AI in Retirement Planning

The Impact on Retirement Planning

Artificial intelligence (AI) is poised to revolutionize the retirement planning landscape, offering unprecedented opportunities for personalized financial strategies and proactive risk management. AI algorithms can analyze vast amounts of individual data, including income, expenses, investment portfolios, and even health information, to create highly tailored retirement plans. This level of personalized planning allows individuals to anticipate potential challenges and adjust their strategies accordingly, potentially mitigating risks and maximizing returns. Furthermore, AI can automate many aspects of retirement planning, freeing up individuals and advisors to focus on more complex or nuanced issues.

By constantly monitoring market trends and economic indicators, AI can provide critical insights into potential risks and opportunities in the financial markets. This allows for proactive adjustments to investment portfolios, ensuring that retirement savings are appropriately allocated and protected from adverse market conditions. Predictive modeling capabilities of AI can help individuals understand the potential impact of various scenarios on their retirement nest egg, fostering informed decision-making and a greater sense of security.

AI-powered tools can also assist in managing the complexities of retirement income streams. This includes optimizing social security claiming strategies, exploring annuity options, and navigating complex tax implications. By streamlining these processes, AI can significantly improve the overall efficiency and effectiveness of retirement planning. This means less time spent on tedious calculations and more time focused on achieving financial goals.

Enhanced Accessibility and Affordability

One of the most significant benefits of AI in retirement planning is its potential to enhance accessibility and affordability. AI-driven platforms can offer personalized financial advice and tools at a fraction of the cost of traditional advisory services. This increased accessibility is particularly valuable for individuals who may not have the resources or access to high-end financial advisors.

AI-powered chatbots and virtual assistants can provide instant answers to common retirement questions and offer basic guidance on financial planning. These tools can be accessed 24/7, making financial information more readily available than ever before. This increased accessibility can empower individuals to take control of their retirement planning and make more informed decisions.

Furthermore, by automating tasks and streamlining processes, AI can reduce the costs associated with retirement planning. This translates into potentially lower fees and expenses for individuals, making retirement planning more affordable for a wider range of people. The potential for AI to revolutionize the retirement planning industry is substantial, offering significant opportunities for both individuals and financial institutions.