The Rise of AI in Financial Markets

The Impact of AI on Algorithmic Trading

Modern financial markets are undergoing a profound transformation through artificial intelligence, particularly in algorithmic trading. Advanced algorithms now process market data at unprecedented speeds, uncovering subtle patterns often invisible to human analysts. This technological leap enables faster, more precise trading decisions that can enhance profitability while reducing exposure to risk.

These intelligent systems continuously adapt to shifting market dynamics, automatically adjusting their parameters to optimize performance. Such real-time responsiveness provides a distinct advantage in today's volatile trading environments where milliseconds can mean the difference between profit and loss.

AI-Driven Risk Management Strategies

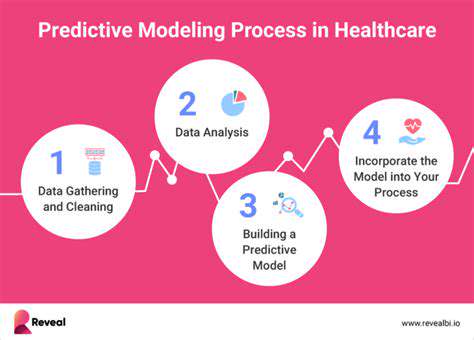

Financial institutions are leveraging AI to revolutionize their approach to risk assessment. Modern algorithms evaluate potential threats with a sophistication that traditional methods cannot match, offering comprehensive protection for investment portfolios.

Through analysis of historical patterns, current trends, and economic indicators, predictive models can forecast risks with remarkable precision. This foresight enables proactive measures to safeguard assets while streamlining the entire risk evaluation process for greater efficiency.

In an era of market volatility, this forward-looking approach to risk mitigation proves invaluable for protecting both institutional and individual investors from significant financial losses.

AI-Powered Investment Strategies

The investment landscape is being reshaped by data-driven approaches that identify overlooked opportunities. Sophisticated analytical models can spot undervalued assets that might escape human notice, potentially yielding superior returns.

These intelligent systems construct customized portfolios aligned with specific investor profiles, continuously refining their strategies in response to real-time market movements. This personalized methodology optimizes both potential gains and risk exposure.

The Future of AI in Finance

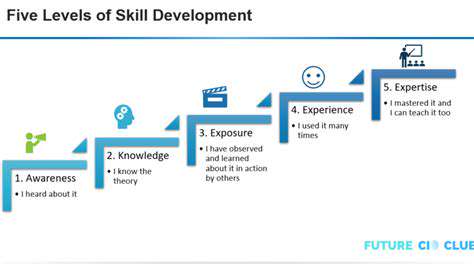

While AI's integration into finance remains in early stages, its potential continues to expand. As the technology evolves, financial applications will become increasingly sophisticated. This progression promises a future where investment decisions are more efficient, data-informed, and potentially more lucrative.

Ongoing advancements will likely yield more accurate predictions, refined risk assessments, and highly personalized financial solutions. The sector stands on the brink of transformation as AI reshapes how we manage and grow wealth.

The intersection of finance and artificial intelligence will undoubtedly redefine global markets in the coming decade.

AI Algorithms for Enhanced Performance

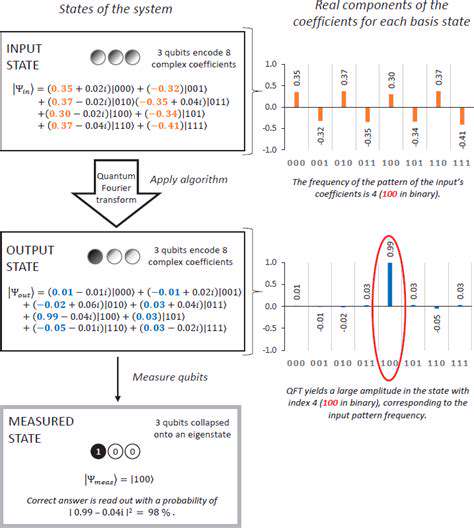

Machine Learning for Pattern Recognition

Advanced pattern recognition capabilities enable identification of complex market relationships within extensive datasets. By examining historical trends, economic data, and company fundamentals, these systems detect subtle correlations that traditional analysis might miss.

Deep Learning for Predictive Modeling

Multi-layered neural networks model intricate market relationships, anticipating fluctuations and adjusting strategies accordingly. Their capacity to process enormous datasets reveals hidden patterns crucial for optimizing investments in dynamic conditions.

Reinforcement Learning for Dynamic Adjustments

These adaptive systems refine strategies through continuous market interaction, learning from outcomes to maximize returns while containing risk. Such flexibility proves essential for maintaining portfolio value amidst market volatility.

Natural Language Processing for Sentiment Analysis

Text analysis capabilities evaluate news and social media to gauge investor sentiment, providing insights into potential market movements. This understanding of public perception helps anticipate reactions to financial news and events.

Evolutionary Algorithms for Portfolio Diversification

Mimicking natural selection processes, these systems evaluate countless investment combinations to identify optimal asset distributions that balance return potential with risk mitigation.

Clustering Algorithms for Market Segmentation

Grouping similar investment opportunities based on characteristics enables targeted strategies within specific market segments, potentially enhancing overall portfolio performance.

Tailored Strategies for Diverse Investors

Understanding Diverse Investor Needs

Investors demonstrate varying objectives, from aggressive growth seeking to capital preservation. Effective portfolio strategies must account for these differences through careful analysis of individual circumstances and preferences.

Personalized Portfolio Allocation

Customized asset distributions reflect individual risk profiles and financial goals. These allocations continuously adapt to both market changes and evolving personal circumstances.

Risk Management and Mitigation

Comprehensive risk assessment models identify potential threats, enabling proactive adjustments to protect portfolio value during market turbulence.

Optimizing for Long-Term Growth

Continuous analysis of market trends and emerging opportunities informs strategic adjustments aimed at sustained portfolio appreciation over extended periods.

Adaptive Portfolio Rebalancing

Dynamic adjustments maintain alignment between investment strategies and both market conditions and investor objectives through constant monitoring.

AI's Role in Enhanced Investment Decision-Making

Data-driven insights and recommendations empower investors with information to make more informed choices about their financial future.

The Future of Portfolio Optimization with AI

AI-Powered Algorithmic Trading Strategies

Next-generation trading systems analyze market data with unprecedented sophistication, identifying opportunities and risks through pattern recognition beyond human capability.

Personalized Portfolio Recommendations

Custom investment strategies reflect individual financial circumstances and goals, dynamically adjusting to personal situation changes and market movements.

Enhanced Risk Management and Portfolio Diversification

Advanced analytics identify and mitigate potential risks while optimizing asset distribution across sectors and investment types for balanced exposure.