Key DeFi Applications: Beyond Traditional Finance

Decentralized Lending Protocols

The rise of decentralized lending platforms has transformed how people interact with financial services. By cutting out middlemen, these platforms let users lend and borrow digital currencies directly. Smart contracts handle everything automatically, making transactions quicker than traditional banks. This setup also lowers chances of fraud, creating a safer space for lending. People worldwide can tap into these services, showcasing one of decentralized finance's biggest perks.

Most systems require borrowers to put up crypto as collateral. While this keeps things liquid, sudden market swings can pose risks. Smart participants always weigh their comfort with risk against market trends before jumping in.

Decentralized Exchanges (DEXs)

Unlike traditional exchanges, DEXs give users full control of their money during trades. Smart contracts replace central authorities, boosting both privacy and security. Every trade gets recorded on a public ledger, keeping everything out in the open.

Many DEXs use automated systems for matching trades instead of old-school order books. This can make markets more efficient, though prices might move differently than on centralized platforms.

Decentralized Derivatives

These platforms let traders bet on price changes without going through middlemen. They offer leveraged positions and various contract types, opening up new ways to manage risk and invest.

But derivatives trading isn't for beginners. Knowing the ropes and having solid risk plans matters. The decentralized setup also brings regulatory questions that demand attention as rules keep evolving.

Stablecoins and Reserve Systems

Designed to hold steady values (often matching the dollar), stablecoins connect crypto's wild swings with traditional finance's stability. This reliability makes them key for wider crypto adoption. People use them for everything from daily purchases to investment strategies.

What backs these coins matters greatly. Transparent reserve systems build trust, so smart users always check how issuers manage their reserves.

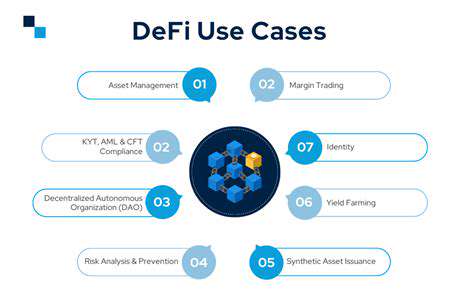

Decentralized Autonomous Organizations (DAOs)

Run by smart contracts and member votes, DAOs rethink how groups make decisions. They represent a radical new way to organize and run projects. This community-led approach boosts transparency and accountability.

But making DAOs work smoothly takes work. Clear rules, risk plans, and ways to settle disputes help. Keeping members engaged presents another ongoing challenge.

Decentralized Finance (DeFi) Lending

These platforms simplify borrowing and lending through automation. By removing middlemen, they often offer better rates while increasing transparency. Users gain freedom from traditional banks' limitations.

Yet risks run higher here. Market ups and downs can shake these platforms, making smart risk management essential for anyone participating.

Decentralized Insurance Protocols

Blockchain-based insurance cuts out traditional companies, using smart contracts to handle claims. This can slash costs while making coverage more accessible. Automated processes remove paperwork bottlenecks.

As a young industry, these systems still need to prove their reliability. Security remains paramount, and unclear regulations add another layer of complexity for now.

The Future of DeFi and its Impact on the Financial Landscape

Decentralized Finance: A Paradigm Shift

DeFi's rapid growth points toward a more open financial future. By building financial tools on blockchains, it threatens traditional banks' dominance. People flock to its transparent, secure way of handling money.

At its core, DeFi's promise of access and fairness drives its appeal. The technology could bring financial services to millions currently left out of the system.

Enhanced Accessibility and Inclusivity

DeFi's biggest strength might be welcoming those traditional banks ignore. Location, paperwork, or regulations often lock people out - decentralized systems break down these barriers.

Without middlemen taking cuts, transactions get cheaper and faster. This could empower entire communities to join the global economy for the first time.

Security and Transparency Concerns

Open systems bring their own challenges. Hackers target weak spots in decentralized networks, and limited oversight leaves some users vulnerable.

Building trust requires bulletproof security and clear ways to audit transactions. Solving these issues will make or break DeFi's long-term success.

The Regulatory Landscape and Future of DeFi

Governments worldwide struggle to regulate DeFi without stifling innovation. They must walk a tightrope between protecting users and encouraging progress.

Clear, smart regulations could help DeFi mature safely. How this plays out will determine whether decentralized finance becomes mainstream or remains niche.