Quantum Speedup in Portfolio Optimization

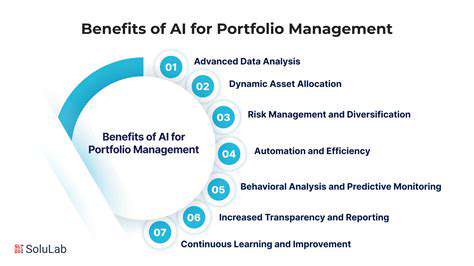

Quantum computing promises a significant speedup in portfolio optimization, particularly in scenarios involving complex financial instruments and vast datasets. Traditional optimization methods often struggle with the computational demands of modern financial markets, leading to limitations in the speed and accuracy of portfolio construction. Quantum algorithms, leveraging principles of superposition and entanglement, can potentially explore a significantly larger solution space in a fraction of the time compared to classical methods. This heightened computational power allows for the analysis of more intricate relationships within the market, potentially leading to superior risk-adjusted returns.

By utilizing quantum algorithms, financial institutions can potentially build more robust and diversified portfolios. This enhanced capability could lead to more efficient allocation of capital, reduced portfolio risk, and improved overall investment performance. Moreover, the ability to model and simulate complex market conditions with greater precision allows for more informed investment decisions and a deeper understanding of market dynamics.

Enhanced Risk Management with Quantum Algorithms

Quantum computing offers a powerful tool for enhancing risk management strategies in portfolio optimization. Traditional risk assessment often relies on simplified models that may not fully capture the intricate and interconnected nature of financial markets. Quantum algorithms, particularly those based on quantum machine learning, have the potential to model complex relationships and dependencies between assets, leading to more accurate risk assessments.

A deeper understanding of risk allows for more sophisticated hedging strategies. By modeling the intricate interplay of various market factors and asset correlations, quantum algorithms could lead to the development of more effective hedging strategies, reducing the impact of unforeseen market events on portfolio value.

Furthermore, quantum simulations can explore a wider range of potential scenarios, allowing for a more comprehensive understanding of portfolio vulnerability to different types of market shocks. This enhanced risk assessment can translate into more robust and resilient investment strategies, safeguarding portfolio value in turbulent market conditions.

Quantum algorithms can potentially uncover hidden patterns and correlations in market data that are not apparent using traditional methods. This ability could lead to the development of novel risk measures and more effective portfolio diversification strategies.

Exploring New Frontiers in Algorithmic Trading

The potential of quantum computing extends beyond portfolio optimization to influence algorithmic trading strategies. Quantum algorithms can rapidly analyze massive datasets, identifying intricate patterns and correlations that might be missed by classical algorithms. This capability empowers the development of more sophisticated and responsive trading strategies, potentially leading to improved trading performance.

Quantum machine learning algorithms can be employed to predict market trends and price movements with greater accuracy. By modeling market behavior with higher precision, algorithmic traders can execute trades more effectively, potentially generating higher returns.

Quantum computing offers the potential to create new classes of algorithmic trading strategies that are not currently feasible with classical computers. By leveraging the unique capabilities of quantum algorithms, investors can gain a competitive edge in the dynamic world of financial markets.

This includes the ability to execute more complex trading strategies, optimize trading parameters in real-time, and potentially identify arbitrage opportunities more efficiently. The possibilities for revolutionizing algorithmic trading are significant.

Quantum Machine Learning for Fraud Detection

Quantum Computing's Potential for Fraud Detection

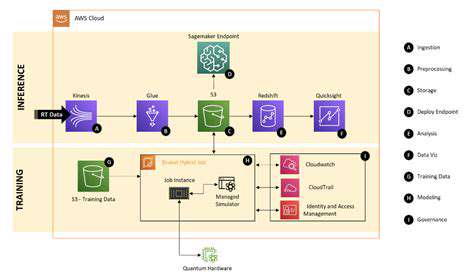

Quantum computing promises revolutionary advancements in various fields, including fraud detection. The inherent parallelism and unique capabilities of quantum algorithms could potentially identify complex patterns and anomalies in vast datasets that traditional methods struggle with. This could lead to a significant increase in the accuracy and speed of fraud detection systems. Furthermore, the ability to process massive amounts of data simultaneously could allow for the discovery of intricate relationships and subtle indicators of fraudulent activity that are currently hidden.

Quantum Algorithms for Anomaly Detection

Quantum algorithms, such as quantum support vector machines (QSVM) and quantum neural networks, offer the potential to surpass traditional machine learning models in detecting anomalies. These algorithms can process data in a fundamentally different way, potentially identifying patterns and outliers more effectively. This could lead to more robust and accurate fraud detection systems.

Quantum algorithms can potentially handle complex data structures and high-dimensional feature spaces, which are common challenges for traditional machine learning methods. This could result in a more comprehensive and accurate analysis of transaction data, leading to a significant reduction in false positives and a more efficient fraud detection process.

Data Representation in Quantum Computing

Representing data in a quantum format is a crucial aspect of quantum machine learning for fraud. This process often involves encoding data points as quantum states, which can potentially capture intricate relationships between different data attributes. This quantum representation can help to identify subtle correlations and patterns that are often missed by classical methods, leading to more accurate fraud detection.

Quantum Simulation for Fraudulent Activities

Quantum simulation could be used to model and simulate various types of fraudulent activities. By creating quantum analogs of real-world scenarios, researchers can explore and understand the intricate mechanisms behind fraud, allowing for the development of more sophisticated detection techniques. This ability to simulate complex scenarios is a key benefit of quantum computing, enabling the testing of fraud detection models in realistic and challenging situations.

Challenges in Implementing Quantum Machine Learning for Fraud

Despite the potential benefits, significant challenges remain in implementing quantum machine learning for fraud detection. These include the development of efficient quantum algorithms tailored to fraud detection tasks, the need for large-scale quantum computers with sufficient qubits to process real-world datasets, and the development of reliable quantum algorithms that can handle the noise and errors inherent in current quantum hardware. The high cost and complexity of quantum hardware are major hurdles that need to be overcome to make this technology broadly accessible.

Scalability and Practical Applications

A key consideration is the scalability of quantum machine learning solutions for fraud detection. The technology needs to be able to process large volumes of data and handle the increasing complexity of fraud schemes in a timely and efficient manner. The practical applicability of quantum machine learning in real-world fraud detection systems requires significant advancements in both hardware and software. The development of efficient quantum algorithms, along with advancements in quantum hardware, is crucial for the widespread adoption of this technology.

Future Outlook and Research Directions

Future research in this area should focus on developing more robust and efficient quantum algorithms for fraud detection, as well as exploring methods for integrating quantum computing with existing classical fraud detection systems. The integration of quantum computing with existing fraud detection systems could significantly enhance the efficiency and effectiveness of fraud detection workflows. Further research is needed to address the challenges related to data representation, algorithm development, and hardware limitations.